May Investment Commentary

< BACK

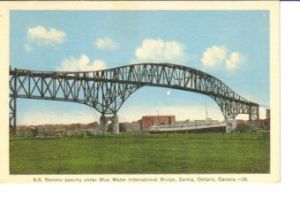

The Noronic Under The Bluewater Bridge

APRIL HIGHLIGHTS

|

Canadian dollar surged past the 90 cent (U.S.) mark, hitting highest level in seven months.

Persistent high oil prices are translating into higher prices at the pumps and creating increased concerns about inflation.

Leveraged buy-outs and merger & acquisition (M&A) activity are on pace for another record-breaking year.

Profit growth in North America remains strong. Q1 S&P500 profit growth is forecasted at 9.4% versus the consensus estimate of only 3.3% used earlier in the year.

The Dow broke through 13,000 and saw its best one-month gain since October 2003.

World GDP forecast were revised upward to 5.4%.

|

Based on economic data alone, April had the makings of a dark month.

Three economic worries weighed heavily on the minds of economists in April:

Rising inflation;

Table 1– Summary of major market developments

|

Market returns

| April

| YTD

|

S&P/TSX

| 1.9%

| 3.9%

|

S&P500 (US$)

| 4.3%

| 4.5%

|

S&P500 (C$)

| 0.2%

| -0.7%

|

NASDAQ

| 4.3%

| 4.5%

|

Russell 2000

| 1.7%

| 3.4%

|

FTSE 100 (U.K.)

| 2.2%

| 3.7%

|

NIKKEI 225 (Japan)

| 0.7%

| 1.0%

|

EAFE (C$)

| 0.1%

| 2.5%

|

EAFE (local currency)

| 2.6%

| 5.4%

|

| | |

Canadian Bond Market

| 0.0%

| 0.9%

|

World Bond Market (US$)

| 0.1%

| 0.7%

|

*local currency (unless specified); price only

|

A slowdown in the U.S. housing market; and

Decreasing U.S. consumer confidence.

Fortunately, low unemployment continues to be a bright spot in both the Canadian and U.S. economy. None-the-less, the U.S. consumer felt the double whammy of rising prices at the pumps and the decreasing equity values of their homes. So with more bad economic news than good, how is it that April was the strongest month this year for North American stock markets?

M&A Math

The single most prevailing force driving the stock markets in 2007 (…and 2006… and a bit in 2005 too) is the ongoing M&A activity. The traditionally technical and data-heavy industry news sources (the likes of Barron’s, Reuters and Bloomberg) had headlines that read like the Hollywood tabloids, announcing rumours of new partnerships, corporate courting, successful bids, commitment issues, and scorned suitors.

How prevalent is the M&A activity? In the U.S. this year announcements for $794 billion (U.S.) in M&A and leveraged buyouts have been reported. A number of factors have led the current environment to be conducive to the continued M&A activity.

A. Companies have healthy balance sheets with little debt.

B. Corporate earnings growth continues to be attractive.

C. The cost of borrowing continues to be low.

A + B + C = An attractive opportunity to buy a company and leverage using debt for even greater earnings potential.

It doesn’t take a mathematician to see that companies are feeling strong and confident about the value in their own businesses. Whether a company buys back its own stock or a suitor comes in with a takeover bid, it drives the stock price up.

Table 1 shows that major world markets landed in positive territory for the month of April. The NASDAQ and the S&P500 had particularly strong months. Investors continue

to feel good about their prospects in the Euro region and the EAFE index has delivered strong results in April and year-to-date. While both the S&P500 and EAFE index had strong months in local currencies, the relative strength of the Canadian dollar dampened returns for Canadian investors.

Make me an offer!

The Telecommunications sector was the best performing sector in the Canadian market, rising 10.3% in April (see Table 2). M&A activity drove this sector higher as the mere rumour that BCE (Bell) was a buyout target, the stock rose higher and brought sector heavy-weights Rogers and Telus with it.

The worst performing sector was the Information Technology sector, down 5.1% on stock specific news. Research in Motion (RIM) had done particularly well earlier in the year, and in April gave back those gains in part due to a lackluster reaction to their Q1 earnings, and ongoing legal concerns relating to their stock options dating process. Nortel also dropped in price on continued concerns about the health of the company, and analyst downgrading.

For fixed income investors, M&A activity did not translate into positive news. While the equity market sees leveraged buyouts as more money in the markets, the bond market simply sees it as more debt on the books. The additional debt to the corporate balance sheets deflated the value of corporate bonds, including the likes of BCE and Sobey’s. As a result, the same M&A oxygen that fuelled the equity market fire, stifled bond market gains.

Table 2 - Sector level results for the Canadian market

|

S&P/TSX sector returns

| April

| YTD

|

S&P/TSX

| 1.9%

| 3.9%

|

| | |

Energy

| 2.6%

| 2.5%

|

Materials

| 0.6%

| 3.6%

|

Industrials

| 5.0%

| 11.8%

|

Consumer discretionary

| 2.5%

| 6.9%

|

Consumer staples

| 4.0%

| 3.3%

|

Health care

| -1.1%

| -4.1%

|

Financials

| 0.5%

| 3.0%

|

Information technology

| -5.1%

| -5.5%

|

Telecom services

| 10.3%

| 18.1%

|

Utilities

| 5.0%

| -2.2%

|

*price only

|

Avoid buyer’s remorse.

While we welcome the M&A activity and its driving force in fueling stock markets gains, it does wreak havoc on market volatility. By its very nature M&A activity is unpredictable, stock specific and rumour based. As April’s results indicate, market reactions to stock specific news can create significant swings up (Telecom services) or down (Information Technology). Fortunately, long term and diversified investors can benefit from the sum of all the parts, and not get caught up in the volatility of emotion-based market timing – where the risk of buyer’s remorse can be high!

Posted: May 2007

< BACK